UI researchers are studying safe driving monitors. (Radio Iowa photo)

University of Iowa researchers are studying the electronic gadgets car insurance companies are asking customers to install in their vehicles to monitor driving habits.

Richard Peter, a UI professor of finance, says the devices are typically provided by the insurance company to promote safe driving, and they usually bring significant discounts on insurance premiums. That sounds like a win-win, right? Well, Peter says, no.

“They measure people’s driving behavior in real time,” Peter says, “so they look for things like speeding, sharp acceleration and braking, hard cornering, and these types of things.” While the devices were introduced in the late 1990s, few drivers are installing them to take advantage of the cost savings.

Peter says only about 5% of motorists in the U.S. are using the tiny monitors, and he’s considering the reasons why they’ve never caught on.

“The most obvious one might be the ‘Big Brother’ argument that people have privacy concerns about how their data might be used,” Peter says, “but at the same time, we think that this explanation doesn’t seem to be particularly convincing, while consumers state privacy concerns at the same time they give up their data voluntarily in all kinds of contexts.”

Richard Peter. (U-I photo)

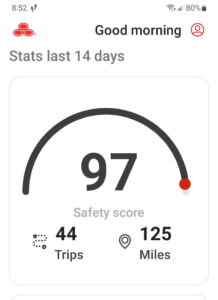

The sensors monitor a driver’s actions and use algorithms to create a score that’s the basis for how large of a discount the driver may receive. Safer drivers will save more money. Still, it’s not a perfect system, as your score may be dinged if you slam on the brakes. “The context matters, so if you have to brake hard to avoid an accident, isn’t that a good thing,” Peter says, “and can you really be sure that the technology picks up the context of that particular driving situation?”

That algorithm may be too complicated for some people to follow, and Peter suggests policyholders fear they’ll be misclassified as a bad driver even when they’re driving safely, which is why many people may pass on the devices. “The main benefit for the insurance company is, obviously, to have access to data about people’s actual driving behavior,” Peter says. “There is some preliminary evidence that feedback from new technologies can also lead to favorable changes in people’s driving behavior, so it can help people become safer drivers.”

Peter says a German insurance company quit using the devices after its customer service lines were flooded by drivers calling to explain their driving behaviors which may’ve registered on the device as erratic. The UI study will be published in the Journal of Risk and Insurance, the flagship journal of the American Risk and Insurance Association.